RECOIL OFFGRID Preparation Keeping Your Finances Afloat Above Covid

In This Article

Americans face challenging financial times as the coronavirus pandemic continues to wreak havoc on the economy. The definition of how society and the economy works is changing as companies shift to increased reliance on telecommuting. A significant fraction of the American workforce may never see an office again. Migrations out of cities to communities offering better lifestyle options for remote workforces is resulting in an active real-estate market in suburban and rural areas of the country even as urban centers atrophy. This, in turn, is causing a crisis for commercial real estate and banks as companies begin to take advantage of less need for office space. The middle tier of the consumer economy, small businesses, is cratering under the combined weight of COVID-19 operating restrictions and fewer customers even when those restrictions are relaxed.

Historically, major pandemics take two to three years to work their way through the world population. The record shows multiple waves of the disease rising and falling. It goes on until the sickness works through all of humanity. With a virulent R-Zero transmission factor of 2.3, there’s no reason to believe the epidemiological process isn’t playing out the same way this time.

At the time of writing this article, a mere six months of the first wave of COVID-19 have impacted planet Earth. At the mid-year point of 2020, the world’s nations are once again beginning to see surges of the SARS-CoV-2 virus, prompting a second wave of economic shutdowns across the planet.

For the first wave of COVID-19, the United States threw the might of its economic power into easing the financial impact of the coronavirus on Americans. The CARES Act provided supplemental funds to U.S. taxpayers, subsidized unemployment benefits to the laid off, distributed Payroll Protection Program funds to help business retain employees, offered mortgage, credit card and rent payment relief, and more. As the second COVID-19 wave hits, the U.S. is once again examining to what degree the nation can, or cannot, tend to the economics and quality of our lives.

The reality check we all need to face though is that government can only do so much. Yes, there are those among us who want to be completely cared for even if it means relinquishing their freedom. But that’s hardly everyone in this nation of 330 million people. There are many more people in this country who value their hardy self-reliance and ability to survive independently. Americans are diverse and come in all kinds of demeanors. U.S. national policy must not only accommodate all of these belief sets, it must find a line and make it clear to people where the support ends and the pull your own weight begins.

If you’re reading this publication, you probably want to pull as much of your own weight as possible because it forms an ethos of pride and self-worth, a critical survival factor for enduring difficult times. As the saying goes, the winner is the last one who panics.

We’ve certainly seen more than our share of people going into frenzies in the first half of 2020. COVID-19 pulled the rug out from under almost every aspect of normal life as we knew it in America. We became refugees from the world we knew and loved. As we cocooned, the adventure turned to cabin fever. The rebellion against restrictions followed, manifesting across every lifestyle and political facet of the American jewel. And, after six months, even some of the strongest among us began to show the effects of long-term stress and uncertainty.

During the great plagues, William Shakespeare wrote “The Sonnets” for his benefactors. They were poems imploring people not to give up hope. Although we can’t possibly outshine his poetic eloquence, we’d like to share a message of hope in our own way — through reinforcing the importance of steadfast preparation.

While not everyone has rainy day money, if you do, now is the time to nurture it wisely. Your reserves may have to last you through two to three years with limited opportunities for replenishment. The 1918 H1N1 flu pandemic lasted about this long with multiple waves of sickness going around the world. It dovetailed with the devastation that followed the First World War. It was a difficult time. But in America, it was followed by the Roaring ’20s, a vagabond rebound for the nation that lasted until we overdid it and crashed at the end of that decade. History tends to repeat itself. We could very well be in for the same type of roller-coaster ride. The resilient American’s mission is to endure the doldrum until the winds of progress begin blowing once more.

Most Americans have their deep reserve money either in real estate in the form of a mortgage, or retirement money in the form of IRAs or 401(k)s.

If you own real estate, hang onto it if you can. Minimize the cash flow you need to carry that real estate. If you can, refinance it into lower payments. If you’re looking to sell, note that people are moving around a lot as they adapt to new workplace realities, and the demand for housing is up in desirable areas. It’s also a rental market — people moving around creates demand as they seek temporary housing without long-term commitments. If you own vacation rental property, you may want to look at month-to-month term or corporate contract leasing to stabilize cash flow.

Do note that there’s somewhat of a human downside to some of this. Many landlords are dreading the reality that families they’ve worked with for years in rental units won’t be able to make their back payments and will eventually be evicted. The stories are heartbreaking for both landlord and lessor because, in the end, both are human beings caught up in the trauma of COVID-19.

If you need to tap into your 401(k) money, be careful. There are many rules and pitfalls that accompany taking a loan or hardship withdrawal from your 401(k) account. Check the information on “401(k) Loans, Hardship Withdrawals and Other Important Considerations” from federal regulator FINRA (www.finra.org) on the subject before acting. The restrictions can be severe. The CARES Act also affects what you can do when accessing your retirement egg. “CARES Act 2020: Retirement Fund Access and Student Loan Relief,” also on FINRA’s website, discusses temporary changes authorized by the law.

IRA’s generally cannot be borrowed from, but the CARES Act also created provisions to access money if needed. This page by Merrill Lynch on “The CARES Act and your investment accounts” (www.merrilledge.com/article/cares-act-retirement-rules) details some of these rules. If you intend to make use of this form of relief, you should look up the rules page for the institution managing your actual IRA account.

If you do dip into hardship monies, the one piece of advice I have is spend it diligently. It’s your nest egg. If you can, work out an austerity plan that’ll make the money last up to three years.

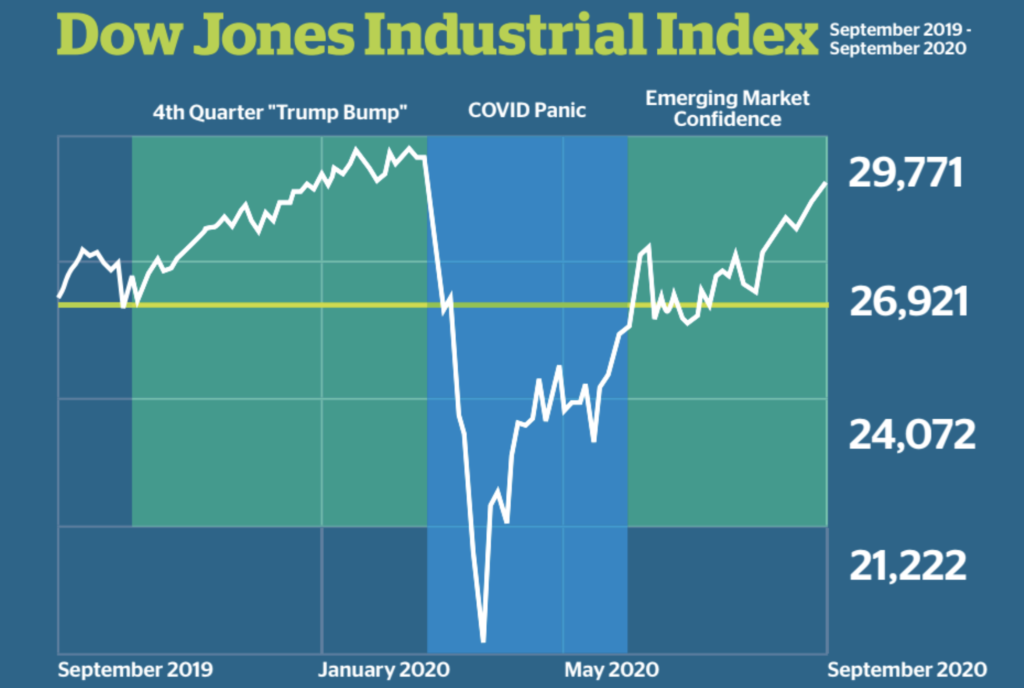

In the world of investments, your experience of the last year has probably truly been a roller coaster. From the heady times of the 2019 “Trump Bump,” to record-high DOWs, into the COVID-19 Shock of the first quarter of 2020, you probably saw every market-linked investment vehicle you owned give you a powerful new grasp on the term “volatility.”

However, don’t count the U.S. economy out! It’s resilient, adaptive, and has proven to shrug off crises time and time again. We may very well be positioned like a powerful coiled spring to lift the U.S. economy to new heights as COVID-19 plays out. Fundamental forces have been strong despite COVID-19. It’s amazing how much business is still going on despite the media’s doom-and-gloom impression that the coronavirus cratered the economy. Things have changed, but essential industries never slowed down. The casualties are in smaller businesses, which aren’t traded on the U.S. exchanges. But competition filled the gap. Into the small-business vacuum, the online economy gained almost a decade of market share growth in a matter of months. So much so, Congressional anti-trust hearings are focusing on the question of whether too much monopoly power now rests in the hands of a few online firms.

The stock market’s growing confidence in the economy is such that the major U.S. indexes are, as of June 2020, at around the same levels they were in June 2019. It’s true that the we've erased the 2019 Trump Bump that took place in the latter half of last year. However, it’s also true that we've erased the panic-driven COVID-19 nosedive of the first half of 2020. That means that as the economy reopens, the fundamental path of recovery — barring any new surprises — favors a return to the 2019 curve. A second bump could very well be the hallmark of the latter half of 2020, provided a second shutdown as debilitating as the first doesn’t hit the nation. Preventing that is up to U.S. officials who may or may not have been paying attention to lessons learned from the mistakes made in the first half of 2020.

On the personal investing side, we hope you didn’t panic buy at the highs and panic sell at the low, a mistake that would’ve lost you around one-third of the value of your investments. If you stayed still, and your portfolio was managed by a reasonably competent investment manager, your investments today would be worth roughly about what they were worth a year ago. You could arguably have gotten the same result taking everything out of the market and putting it in a money market savings account.

That’s the reality of it. What that tells you is that the adage that speculating is the fastest way to lose cash does seem to have been proven yet again. If you have your position in cash, you may or may not want to move some of it into something that yields slightly more interest and has no principal loss risk. That decision is your choice; or rather, you and your broker’s choice. If the money is in an IRA or 401(k), you probably want to favor the funds that have minimal volatility loss risk. Ultimately, what you do not want is another “Beta Risk” market panic event where you bite your nails through another trough. What does that look like? It’s called the November 2020 election.

Last thing on investing, if you want to speculate and play the market, you’re on your own. I’ve seen people who have won some and lost some in the past six months. But they were all using only the disposable portion of their portfolio. I haven’t seen anyone betting the farm on the market.

One of the daily life artifacts of COVID-19 is that America is becoming a cashless society. Cash money, the mighty greenbacks, are touched by people. During a pandemic, anything touched by a stranger’s hands might be a potential vector for spreading the infection.

The result of this is that businesses now prefer payment using credit cards or, even better, touchless payment methods. The most common of these is using Apple Pay or Google Pay, which interact with wireless receivers in payment processing devices safely sitting behind plexiglass shields.

When ordering food for takeout or delivery. Phone apps are the preferred way to not only make the order, but also to prepay the order, and track the progress of the order’s preparation or delivery. Takeout is literally walking in and taking the order out. For delivery, it comes to you, and no cash is ever exchanged with the driver. You can even prepay the tip.

Purchases from supermarkets, department stores, warehouse stores, and fast food are done by slipping a chip or swiping a magnetic stripe into readers while the workers stay safely behind plexiglass. Even many dine-in restaurants serving outdoor dining ask customers to pay for their meals by inserting a card into a reader.

The result of all this paperless buying and selling is that the amount of cash in circulation is decreasing. One artifact of that is a coin shortage. As people use less cash, change becomes idle in people’s jars at home instead of recirculating in the economy. There’s actually only so much metal minted and the amount of it is calculated by the U.S. Treasury four mints in Philadelphia, Denver, San Francisco, and West Point to match the expected flow of cash and change in each service area. COVID-19 has disrupted the supply, demand, and recycling pattern of coins.

If you want to use coins, you might think that keeping a stash is a good idea, but it’s not. The better thing to do is take that gallon jug full of coins to the bank and deposit it. You don’t even have to count it precisely, your bank branch will give you a heavy plastic coin deposit bag, you will make an estimated guess on the deposit slip, and the bank branch will send it to a central coin counting facility that’ll update your deposit slip to the precise amount and credit your account. The coins will then be recirculated to merchants. Presto, no more coin shortage. Maybe an excess supply of coins. Because more people are happily cashless using their phone apps to wirelessly pay of things.

My gripe in all this cashless society stuff? My iPhone doesn’t recognize me while wearing a mask, so using Apple Pay, or a number of other security applications, is more difficult. The software relies on facial recognition technology to authenticate the payment. Even though it’s usually possible to override this feature with a manual passcode, it’s not always easy to do so. This will only become more of an issue in the future as facial recognition sees more widespread use.

With the pandemic expected to last as long as two to three years, it’s not unreasonable to think that future economic assistance packages will appear. These may be stimulus and cash bridging packages like the CARES Act.

There could be new rounds of the Payroll Protection Program to keep small business alive, probably with stricter controls than the original version. In the first round of PPP, 661,218 loans greater than $150K made to businesses by 4,318 financial institutions reported by the Small Business Administration (SBA). An estimated 31,456,513 jobs were saved by the program. This may happen again. If it is, we should use these funds wisely.

There may be new rounds of enhanced unemployment insurance. Given the economic realities of remote workforces and increasing automation of work functions, it may very well become more common for Americans to only work part of the year paying into the system. The other part of the year would be spent taking that UI payment back in an elaborate process that creates a zero-sum solution for the economy until COVID-19 passes. You’d still have to pull your weight for part of the year. That’s probably not a bad thing to expect in exchange for the help.

Or, it could be targeted educational assistance for a parent to stay home to supervise school-age children. A few families could band together to educate their children as a group or “pod.” The group stays isolated from others to limit their exposure to COVID-19 risk. This pod structure is also used to keep shifts isolated from each other in essential services like police and fire departments, limiting the spread of any damage caused by a COVID-19 outbreak in one pod.

The purpose of these assistance programs is to enable living expenses to be met during a period of crisis. That’s what the money should be used for. And the watchword, because this is survival money, is to manage that spending prudentially. The government cannot tell you to be smart about our spending. That’s a responsibility each of us must see as our important contribution to the resilience of our nation.

STAY SAFE: Download a Free copy of the OFFGRID Outbreak Issue

STAY SAFE: Download a Free copy of the OFFGRID Outbreak Issue

No Comments